Buidl Omnichain: LightLink and LayerZero Discuss the Future of Cross-Chain Interoperability

Explore the full transcript of LightLink's Twitter Space with LayerZero, where industry leaders discuss omnichain interoperability, cross-chain tech, and the future of a connected blockchain ecosystem.

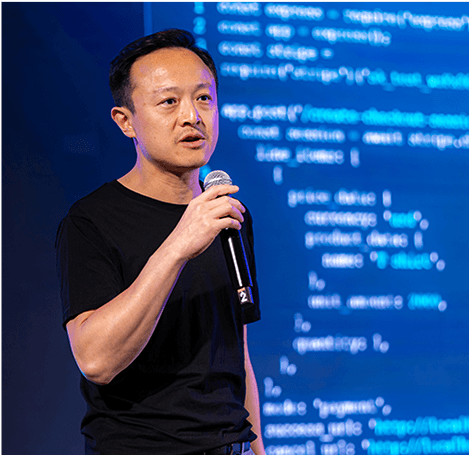

LightLink recently hosted an insightful Twitter Space titled “BUIDL OMNICHAIN with LayerZero” on October 22nd, featuring a discussion between LightLink's Co-Founder and CEO Roy Hui and LayerZero’s Ecosystem Growth Lead, Kenny Zhang. The session was moderated by Dan Enright, LightLink’s Ecosystem Lead.

During the session, the speakers explored the vision and technical nuances of LayerZero’s omnichain interoperability and how it aligns with LightLink’s objective to streamline and abstract complex blockchain processes. We also explored Lightlink's future plans for integrating LayerZero’s OFT standard to optimize interoperability with a focus on onboarding Web2 brands and enhancing user accessibility through gas and account abstraction.

Check out the Full Transcript

This is the full transcript of BUIDL OMNICHAIN With LayerZero Twitter Space hosted by LightLink.

DE: All right, GM, GM, it seems everybody's very punctual for this big Twitter space that we have with LayerZero. Welcome Roy, welcome Kenny, and welcome all of our listeners. Thanks for tuning in. Why don't we start with a brief round of introductions of who we are and maybe a bit of personal experience about your recent bridging experience. How often do you use a bridge to bridge tokens across to other networks?

Just a little bit of an icebreaker for us all. So I'll start with myself. I'm Dan Enright, the Ecosystem Lead at LightLink. And as far as bridging goes, I find myself having to bridge more often than I would like to, because there are quite a few different networks that I like to explore while I'm using the Web3 landscape.

I don't keep a lot of ETH on my hot wallets so whenever I want to use a new chain, I've got to end up bridging from one chain to the other. Most recently, I saw that ApeChain launched like a memecoin launcher. So I had to go and buy some Ape token and then bridge that across. And of course, I use Stargate to do that, which utilizes the LayerZero network. And yeah, it was an easy way to get across — I knew that would be a safe first port of call to do that with. How about yourself, Kenny, let's hear from you.

KZ: Hey, thanks so much for having me on. I'm Kenny, I'm the Ecosystem Growth Lead here at LayerZero Labs. We are an omnichain interoperability protocol that connects 90+ chains. In terms of the bridging question, I'd say I also find myself bridging pretty often. Most of that is driven by a demand to kind of explore, you know, newer chains and newer ecosystems, but also to move and transfer funds between chains with higher TVL, right? Like the Ethereums, the Solanas, the Arbitrums.

So I've been building in the cross-chain space for about three years now. So, yeah, pretty aware of all the different bridging solutions. And, you know, obviously a little bit biased towards LayerZero and Stargate, but that's a brief description of how I'm bridging these days.

RH: Thanks Dan for hosting. Nice to meet you. Kenny. Big fans of LayerZero. Hi everyone, my name is Roy. I'm the co-founder of LightLink. I think there's a lot of things that we can do utilizing cross-chain messaging capabilities that LayerZero is able to offer. It really aligns with the vision that we have for the future where LightLink is all about orchestration, abstraction, helping larger Web2 brands explore and leverage this space.

From my personal cross-chain bridging experience, yesterday, I was exploring working with our partners in our ecosystem to find an answer. And a lot of my experiences are driven from demand, from how can we solve a problem in the real world?

So this particular problem that we're trying to solve is an international aid organization trying to bridge USDC from ETH to LightLink, and then looking at how we can wire that up to an off ramp partner for the Sub-Saharan African utility. And It's predominantly around international money flow and local regulatory licensing. We're just actually playing around with the OFT and omni applications that LayerZero is experimenting around, trying to see if there's a solution around there. So yeah, really, my experiences are very much under the hood about other protocol levels and it's a really interesting experience.

DE: Yeah, awesome. Thanks, Roy. Perhaps for our listeners who may not be fully aware of what LayerZero is and the omnichain concept. Kenny, could you give us a bit of an overview of the protocol, as well as what omnichain is?

KZ: Yeah, absolutely. So, omnichain is the ability to deploy applications that are not just siloed on one chain, but rather all interconnected, right? And to give a little bit more about the origin story behind LayerZero, it was really in 2021 when this multi chain thesis kind of formed. There was Ethereum, and then there were other alternative ones, like BNB chain and Solana, that kind of came up. And so I think our co-founders initially tried to develop a game on BNB chain, but they found that, you know, the bridging experience between Ethereum and BNB chain was very clunky at that time.

And then, you know, there's kind of this cambium explosion of alts, sometime after that. And so I think there was more and more of a thesis being formed for, like, a layer that connects all these chains. And that's really what LayerZero is right? We are the market leading omnichain interoperability protocol. We connect chains from an EVM, any chain, and, you know, certainly excited to welcome LayerZero into our ecosystem.

DE: Yeah, we're very happy to be a part of the network as well. I mean, it just opens up so many doors for us, not only, you know, bridging across networks, but also the ability for developers to build across multiple chains as well utilizing our space as like a high execution, high throughput layer. Perhaps we could dive a little bit deeper. I mean, there are, there are lots of bridging solutions available. How does LayerZero's differ from those that are out there? You know, your competitors like Wormhole or Axelar? What sets LayerZero apart?

KZ: Yeah, I think the largest two aspects are really security and scalability. Right now we're live on the most amount of chains of any infra protocol. We're able to scale at a much faster speed than some of the competitors in the space, as well as security. So there are a few things that make LayerZero very secure to build on. We have modular security stacks for developers. This is kind of part of our idea called DVNs.

What a DVN is, is that any permissionless party can serve for the verification layer, for LayerZero Labs, for the protocol, rather, sorry. So the idea is that, like each of these kinds of parties, has their own independent verification method, and those lie somewhere on a cost-security scale. So if you're a game sending a bunch of micro transactions, you might want to optimize for speed. If you're a DeFi protocol securing billions of TVL, you might want to optimize for something more secure.

On top of that, we have the largest bug bounty in the space at $15 million and you know, for a period, there was a time where cross-chain and bridging was almost synonymous with some sort of notable exploit or hack. And you know, we're proud to say that LayerZero, because of some of these measures, has never really had any sort of prominent hack or, you know, security exploit at all. So that's something that we take pride in. The next thing is, you know, just market adoption. I think some of our product standards, like the OFT or Omnichain Fungible Token standard, and ONFT Omnichain Non-Fungible Token standard, are some of the most widely adopted cross-chain token standards in the space right?

We have everything from liquid stake versions of ETH, liquid re-stake versions of ETH, stablecoins, memecoins, you name it. I guess you know, just naming some of our largest OFT's from each category for memes, we have PEPE and WIF. For LRTs and LSTs, we have Wrapped eETH (WEETH) by ether.fi as well as Restaked ETH (RSETH) by Kelp Dow. And then for stablecoins, we have tokens like Magic Internet Money (MIM) by Abracadabra money, and then also USDe by Ethena.

DE: Yeah, amazing. It's great to see the amount of adoption and uptake there is of the OFT standard. So over to you, Roy. You've mentioned a few times that you've outlined blockchain abstraction as LightLink's positioning within the market. How do you see omnichain capabilities fitting into our chain abstraction, gas, abstraction, account abstraction toolkit?

RH: Yeah, great question. I think the future is omnichain and one of the biggest problems that we have as an industry is fragmentation. You have many different chains, like Kenny said, over 90 different chains integrated, and every single one of those chains is fighting for retention, TVL users, apps, so on, so forth. And when you have such a spread of attention to do something in unison, it is fairly difficult.

At the same time, when you look at where we will go as an industry, it's incomprehensible for users to install 90 different wallets, right? They would probably eventually gravitate towards a single or a couple of payment systems, a couple of financial ecosystems that they gravitate towards. So I think if you look at those two components, a consolidation, a bridging between the various ecosystems, having a level of abstraction is really important. So that's where we are heading towards, as well as a network.

We started with a gas abstraction, trying to remove complexity, reduce barrier of entry, and then look at how can we increase the scalability of onboarding using our ZK authentication, as well as introducing an API layer to interact with the chain, and therefore removing the requirement for in-depth crypto knowledge to interact with the blockchain. So the next step is, how can we piece it all together to create a meaningful user experience.

We would, of course, need to tap into liquidity or capabilities across different chains out there. And LayerZero is, of course, the obvious choice to provide that cross-chain messaging, bridging token standard capability. I can really see LightLink to be an orchestration layer on top of the different things that we are working towards. So for example, if you are conducting activities for your reputation, then it probably makes a lot of sense to store that valuable piece of information on the chain that is lower cost, high velocity, high capacity.

You can read that information when you need to on all the chains out there. And you can use LayerZero for that cross-chain communication capability. But storing that data would be prohibitively expensive across many other chains out there. Reputation is only one of those key elements. It could be, you know, gamification, you know, leveling up achievement records. It could be various aspects of identity, various parts of you know, verifiable credentials and many elements that might not be what we're currently seeing in the crypto space today,

DE: Awesome, yeah. I think what you said rings true of what the Omnichain Fungible Token standard does unlock for us all. I mean, one thing that we're going through at the moment as a network is we're updating, or basically introducing a new bridge, a trustless bridge, which will help our chain, I guess, rollup in a more secure manner, to Ethereum Mainnet.

In doing so, we're going through, I guess, introducing the standards that some other chains have, such as the 7-day withdrawal period to go back from Layer 2 to Layer 1. One downside of is the wait time for people to get their liquidity back to or across to another network.

And so in this process, we've been very happy to be accepted by the Stargate DAO as part of a new integration there, and therefore we'll be able to utilize the USDC and USDT, OFT hydra assets that they can provide to networks. So that means that we'll have a USDC token that will be, I guess, a unified liquidity pool across the network, supported on LayerZero, which is great. Maybe Kenny, could I ask you to expand a little bit on the Omnichain Fungible and Omnichain Non Fungible Token standards for everybody that may not be fully aware of what that is and how it operates?

KZ: Yeah, for sure. So the OFT, or Omnichain Fungible Token standard, is a cross-chain token standard. It's really just appending a few lines of codes to any existing ERC-20 that connects them to the endpoints and connects the different smart contract deployments that you have for that particular token, and allows for mint and burn transfers 1:1 across any chain.

And so the idea behind this is that before the advent of the OFT standard, bridging two new chains, individual tokens was a very clunky process. You would either have to route through the middle chain or have what we like to call wrapped assets, which is where you go through a permissionless bridge, you lock your tokens there, and then you mint a representation of that token on the destination chain.

And there's a few problems with that. One is that on the destination chain, the original token developer has no ownership of that contract. For that wrapped asset, they are not allowed to make any changes to it, like they don't own the contract, right? And so there's that issue. And then besides that, there's the issue of having, like, you need extra liquidity, because then you would need to facilitate some sort of liquidity pool for the wrapped asset to a native asset. Then beyond that, those funds that you're locking on the source chain, if anything was to happen to those funds that are locked before minting the representation on the destination chain, then that essentially renders the representation on destination useless as well, right?

So, we've seen that happen a few times where, you know, these kinds of pools of assets that are locked for these wrapped assets on the source chain, they serve as like a honeypot for hackers, right? Because they kind of just sit there in perpetuity and they gather up to, you know, millions of dollars, billions of dollars, sometimes. And so for a hacker, it's a really lucrative opportunity, if they can go in, exploit the code, somehow take advantage of those funds that are locked on the source chain and then render those funds on the destination chain useless.

What we have with the OFT standard is essentially a way to mint and burn 1:1 transfer without the use of liquidity pools, middle chains, wrapped assets across chains. And so this way, there's no sort of slippage. Everything's 1:1, right? If I want to move, you know, $100 of a stablecoin and basically any size, let's say I wanted to move a billion dollars of some stablecoin from chain A to chain B, I could do that via the LayerZero OFT standard, by just burning those billion tokens and then natively minting them on destination.

Traditionally, you'd probably have to pay quite a lot of slippage if you're dealing with that type of size. But with LayerZero, you're able to do that with unlimited size just by paying the price of gas. So for us, we think it's a really novel, unique convention. We've been able to onboard a lot of different assets across DeFi, gaming and just Web3 in general, on the OFT standard.

And if you think about it, the most bridged tokens are probably some of the highest market cap tokens in the space, right? These are different versions of Ethereum, you know, Bitcoin and then stablecoins. And we managed to kind of onboard all of those, right? So as I mentioned, we have a few different liquid restake versions of ETH. Have a few stablecoins. And recently we announced an integration with BitGo for wrapped Bitcoin as an OFT and many other assets.

DE: Yeah, certainly awesome tech. We're very excited about having tokens that are integrated with the OFT standard, and also, being bridged across to having other tokens potentially add LightLink as an end-point for where their tokens may be bridged to as well. Roy, perhaps you could go into a little bit for us, and I'll add to this after you provide your response, but could you shed a bit of light on how LightLink plans to leverage the OFT standard in the future?

RH: Yeah, sure. And I think I know what you're going to talk about, so I'll leave that to you. In terms of OFT, I think it's really such an important standard to follow because it creates that interoperability. So we get involved in a lot of different projects, and LightLink is a component of those project-based conversations. And we would always advise these projects to consider an OFT standard, as opposed to an Ethereum-based ERC-20 standard. And if you did use the standard ERC 20, you would need to create a wrapper, and therefore adding further resistance for cross-chain communications.

I think OFT by default in a lot of newer initiatives that we're exploring, so for example, if we are creating a token launcher, for example, it would just be OFT by default. And I really enjoyed the blog that LayerZero put together in terms of 11 different use cases for omnichain Dapps. Another really exciting project I think you guys probably heard previously is our partnership with Gravitaslabs to help Lamborghini in the Web3 space. And as a part of that project, USDC is an important component of the project. So we were trying to work with Stargate with LayerZero to get the OFT version of USDC deployed ASAP so we can do more things with that token for the Lamborghini Project. And that's tremendously exciting as well. Okay, over to you, Dan.

DE: Yeah, so, as I mentioned before, we're updating our bridge and therefore some of the ERC-20 tokens that were bridged across to our network will need to be, I guess, re-established as OFTs. That will include our LightLink token, the governance token for the network. So we're going to have to go through an exercise of bringing back a lot of the supply from LightLink to the Ethereum Mainnet chain, which is where the token was originally minted. And we're going to transform that token, or, you know, adapt it into an OFT.

But we're working closely with the Aragon team, who have introduced a multi-chain governance plugin for their DAO stack, which utilizes the LayerZero protocol and the OFT standard to ensure that tokens can be adapted and used for governance across chains. So we're very excited about this aspect, because, you know, it solves a number of problems for us. We can not only enable fast bridging to and from Ethereum Mainnet to our network, but, you know, who knows, maybe in the future, LightLink token has a need to be on another chain as well, other than Ethereum Mainnet and our own.

But also we don't need to go through the exercise of wrapping our token in order to participate in governance, voting for our community as well. So we're very excited about that. We're working closely with the Aragon team to ensure that we're deploying what they've built as it should be, in a secure manner, and it allows those that hold our LightLink tokens, not only on Ethereum Mainnet, but also locally on LightLink Network, to participate in governance as well. So yeah and all of this is possible thanks to the LayerZero integration and tech that you guys have built in. So, yeah, that's just a little bit of, I guess, a sneak peek of what we're cooking behind the scenes. But yeah, very excited to deploy that.

So Kenny, I might ask for your opinion on something as well. We're seeing a lot of adoption of LayerZero as a bridging solution. Like, I think a lot, probably the majority of traffic on LayerZero is from people bridging from Layer 2 network to other Layer 2 network, or from Layer 2 to Layer 1 network and vice versa. But you know, LayerZero unlocks a lot more than this, such as the ability to build omnichain applications, which, you know, don't necessarily make use of the OFT standard, but instead, you know, direct message within an application to different networks. So could you give us a bit of, I guess, like if we were to aspire to build something more than just a bridging solution within the space, what are some of the ambitious ideas that you think haven't yet been built? And what would you love to see built as a demonstration of omnichain capabilities?

KZ: Yeah, absolutely great question. I think Roy alluded to a very good piece called "11 Big Ideas to Build Omnichain." So that's a really good place to get started. But for me personally, and I'm really glad you brought up the example of Aragon, right? They're building something really cool with gasless, like no fee governance voting on L2s that sync back to L1 and then are able to subsidize those DAO votes through a pay master.

So I think that's really cool for me personally, one thing that I've been kind of harping about for a while is an OFT AMM. And the idea is that, like every liquidity pool and every tradable asset on this DEX would be an OFT. So everything on the DEX itself would be truly omnichain, right? So you're able to bridge in and deposit into LP pools on like any chain, and then similarly, you're able to receive LP tokens that can be bridged seamlessly across any chain the DEX supports. So I think that's an idea that's really interesting. Another idea that we think is really cool is the idea of these omni trade smart accounts.

I think to date, EOAs, or externally owned accounts, are quite limited in what they can and can't do. But these days, we're seeing the advent of new smart contract wallets, right? It'd be really cool to have a smart contract wallet where, essentially there's programmability across chains, and there's a unified smart account standard that allows for things like balance abstraction and key changes across multiple blockchains that would just, like, streamline the user experience a lot. So those are some of the ideas that I think, personally, would be really cool. And you know, hopefully we do see some of these novel use cases built out right?

I think there's infinite possibilities that can be built on LayerZero, right? You're not just limited to value transfer or bridging in the traditional sense. You can send any packet of data on the internet from chain A to chain B. And I think there's a lot of cool use cases that we haven't tapped on yet. But I think for the purpose of, you know, getting started with, like, an idea of the different things that can be built on LayerZero that are a little bit non standard, the 11 Big Ideas blog posts is a really good place to start.

DE: Yeah, absolutely. It's just the beginning, it feels like. There's so many untapped, sort of capabilities of the protocol that we're yet to see. And as Roy mentioned, we are looking at the moment. We've seen these token launches that are available on some of the networks being established. And I think if we were to do that ourselves, we would make all tokens launched on that, OFT by default. Because I think, inevitably, one day, we're going to see omnichain AMM available. And it just makes so much sense to ensure that tokens released going forward are compatible with that future. Roy, how about you? What would you like to see built on LightLink that showcases full omnichain capabilities?

RH: Yeah, great question. Kenny, I really enjoyed the article — that "11 Big Ideas." I've shared that internally with the team to explore maybe proof of concepts. I think the omnichain AMM is definitely super interesting, because it solves the entire fragmentation issue for our entire industry. We've actually experimented with smart accounts, so we've got a working prototype, which I'll share via tweet, maybe later in the day. It looks at different chains and tries to consolidate a unified balance, or uses our ZK authentication capability, which implements the gas abstraction, as well as account abstraction, concepts that we're talking about earlier.

In terms of myself, I have two areas which I find a potential, substantial opportunity for us. One is around identity, because as I was saying earlier, LightLink could be an orchestration layer, using LayerZero as a cross-chain messaging capability. But your identity is persisted through all of these different networks out there. We share the same encryption standard, the whole signing with ETH, type of credentials, but the things that you accrue as a part of your Web3 journey, whether if it's gaming or permanent records or identity or reputation, all those things can be stored on LightLink.

And that concept, that design, really talks about using the chain for its purpose. So maybe LightLink is more for the enterprise, high-velocity, high-capacity, type of things where Ethereum might be more applicable to, you know, the crypto punks, or, you know, native USDC transactions and things like that. So the other is actually money, which is a fantastic and really interesting subject matter. When you look at money, generally, you know you have wholesale and retail, right? So wholesale is where maybe the Federal Reserve issues large sums of capital to commercial banks, you know, in the scale of, you know, hundreds of millions of dollars.

And then these retail banks would operate a credit card or a digital payment app that conducts a very high velocity transaction. And potentially, if you correlate that to the crypto world, you might have USDC or Ethereum as the wholesale basic transactions. Then you might look at the Layer 2 architecture landscape as higher velocity retail transactions, and it makes a lot more sense for you to walk into a coffee shop, utilize the app and tap on the app to conduct you know that financial transaction where, in the case of LightLink, we just remove the need for gas, which maps a lot more to the real world. But then if you want to convert currencies or buy assets that we can tap into LayerZero to not only explore that wholesale currency transfer experience, but also cross-chain AMM capabilities, like what Kenny spoke about earlier. So yeah, I think the future is omnichain, definitely, and that level of distraction is also really important.

DE: Thanks Roy. Alright, I've got one more question to wrap us up, and it could be a tricky one. When do you think we'll see a truly omnichain world? And what do you see as the hurdles that we need to get over to make that happen? I'll turn this to you, Kenny.

KZ: Yeah, that's another really interesting question. I think it's actually happening right before our eyes. So I think if you take a look at DeFi back in 2020-2021, there are a lot of these kinds of siloed deployments of these DeFi primitives that just existed on one chain. And these are things like your typical AMM, or your typical DEXs, borrow-lending protocols perp DEXs. And these days, more and more, you're starting to see this kind of adoption of the use of capital from other chains to support these initial DeFi primitives.

So these days, on LayerZero, we've already seen things built out like cross-chain swaps. Those have been built on Sushi as well. And then also cross-chain borrow-lending. We have a few money markets that are cross chain where, you know, you can deposit collateral on one chain, borrow against that in another. And then we also have perp DEXs, where you can kind of do the same with collateral, and then going long or short on assets on another chain. So these are all our ideas that were really spun out of, you know, the omnichain thesis.

You don't want to necessarily pitch yourself into one chain. There's access to more users and more liquidity, if you kind of explore simultaneously connected deployments on multiple chains. And so I think we're starting to see that now. It's been really interesting to see firsthand, as well as just a general adoption of the OFT standard. We've been able to adopt some of the largest market cap assets in crypto today, as OFTs. And so I think a lot of these teams deploying these contracts are realizing that it makes sense to, I guess, open yourself up, and have deployments on multiple chains, and not just like siloed instances. So there's a lot of really cool developer tooling and a lot of really cool products that I can't speak about quite yet that I think will really facilitate and streamline the adoption of omnichain. But, you know, I can't talk too much about those, so I would just say to stay tuned for LayerZero, for any news that we have on that front.

DE: Well, that's such a tease. Kenny. I'd love to know more, but, like, this is a personal question of mine. So you know, we see the narrative at the moment around memecoins — they're amongst some of the most highly traded on-chain tokens at the moment. And are you seeing more, I guess, engagement from those deploying these tokens? Do you think that they're sort of coming around? I know that OmniCat, I think, was one of the first to truly deploy omnichain. And PEPE, you know, came around and added on the omnichain support as well. So I just wonder if you'd speak much with these teams that are deploying these tokens.

KZ: Yeah, those are very good callouts. OmniCat was certainly very interesting. They deployed their token contracts simultaneously across a number of different chains, and didn't really see liquidity on those chains. So in theory, you could have just gone back and forth between those chains using the OFT standard, bridging your omni tokens back and forth, and made some money like that. And we did see that for a bit last December. I think these days we are getting more and more, or there is more and more interest in some of these meme coins becoming OFT's.

Most recently, dogwifhat or WIF expanded from Solana to Base in Tron. And so I think, really what drives the thesis for memecoins, and really why, I think Solana has gained a lot of credence for, you know, trading memecoins is having a really good and fast user experience. And I think these days, with the advent of newer technologies and newer scaling solutions, it's not just Solana that provides a great UX for users, right? It's many different chains now. And so I think it makes sense, from the perspective of the project team to just want to go where there's users, right? And want to provide, like, a good trading experience for their users. And so it makes sense to expand to a lot of these high-performance chains as well that are, you know, EVM-compatible. So, yeah, we've been seeing more interest on our side. We certainly think it's interesting. And, you know, we're here for it.

DE: Yeah, it's no wonder. I do see the potential for, I guess, EVM chains to go head to head with what Solana has been able to provide so far for sure. Roy, how about you? I'll just open up that last question that I had around, I guess, the omnichain world and what we need to see in order to realize that? What do you think needs to happen?

RH: Yeah, I agree. I think Kenny spoke about it happening right under our eyes. I think it's happening very fast and very slow at the same time. I think it's an evolutionary process. Before you know it, you will have an AMM that doesn't have that drop-down with the different protocols. It just gives you the best price, and it does everything behind the scenes, and we've largely seen that cross-chain swaps coming to shape. But I think that level of extraction would increase over time. But I think that's still very much in the crypto Web3 space.

I really want to see not only an omnichain world, but a combination of the traditional world to our world, the Web3 world, and I think that would take a bit more time for it to fully take shape, maybe 2028 as a guess. And I think we're quite a few years away, because of the cyclical nature of our industry, of our financial world, but also how corporate, especially financial institutions, adopt technology. So it sort of moves in a timeframe of years. But you know, 2028, isn't too far away from the grand scheme of things, and that's where we would see a substantially more integrated real world economy to the Web3 economy. And a lot of that technology would be running on top of Web3 rails, which is a really interesting feature to look forward to.

DE: Great, I think we could wrap up there. You know, we're super excited to be part of the LayerZero ecosystem. We've got our Stargate deployment coming up, which is very exciting. Which means that, you know, people will be able to bring ETH, USDC, USDT, LightLink token eventually to and from our network and Ethereum Mainnet, you know, in a matter of seconds, rather than one week, which is what it would take on our new standard bridge. Kenny, it's been awesome having you here and hearing from the world of LayerZero. We look forward to hearing about the new Alpha that you just teased on the Twitter feed coming up. Yeah, thanks for joining us.

KZ: Thanks so much for having me on guys. Really enjoyed speaking to you all on the space today, and certainly excited to continue working with the LightLink team in the future.

Yeah, likewise. Thanks, Kenny, and thank you, Roy, for joining us as always.

RH: Thanks, Dan, appreciate you hosting the spaces. Lovely talking with you, Kenny, and super excited about that omnichain, abstracted Web2, Web3, combined world.

KZ: Yeah, for sure, same here on my end.

DE: All right, thanks guys. It's been great to have you all join us today, and we'll look forward to the next space with you all. Thank you.

The Bottom Line

LayerZero and Lightlink are pioneering cross-chain interoperability, tackling the core challenges of blockchain connectivity. LayerZero’s OFT standard is a breakthrough in cross-chain technology, enabling secure and seamless asset transfers without relying on third-party liquidity pools or middle-chain solutions. This design reduces security risks, improves liquidity, and makes cross-chain transactions more efficient.

Lightlink’s integration of LayerZero’s OFT and DBN infrastructure will enhance the network’s flexibility and performance. Through gas and account abstraction, Lightlink aims to simplify cross-chain interactions and build a Web3 orchestration layer, a cross-chain golden record database to unite cross-chain activities on most chains with its gasless, instant transactions.