Rethinking Liquidity Incentives: How Metrom Makes Yield Fairer and More Efficient

Discover how LightLink and Metrom are reshaping DeFi incentives with KPI-based liquidity rewards—boosting sustainability, minimizing waste, and rewarding real contribution.

DeFi runs on liquidity—but traditional liquidity mining has long favored speed over sustainability.

That’s why LightLink is teaming up with Metrom again for Round 2 of our KPI-based incentive program, now live across three Uniswap v3 pools. The campaign will run for 21 days.

👉 Explore the pools and start earning: app.metrom.xyz

Metrom offers a smarter, more efficient way to structure incentives—aligning rewards with performance and rewarding long-term contribution, not just early participation.

Let’s break down how it works—and why it matters.

What Is Metrom?

Metrom is a next-gen liquidity mining platform that lets projects launch KPI-based reward campaigns in minutes. It’s designed to reduce inefficiencies and reward LPs based on their contribution to a pool’s growth—not just how early they arrive.

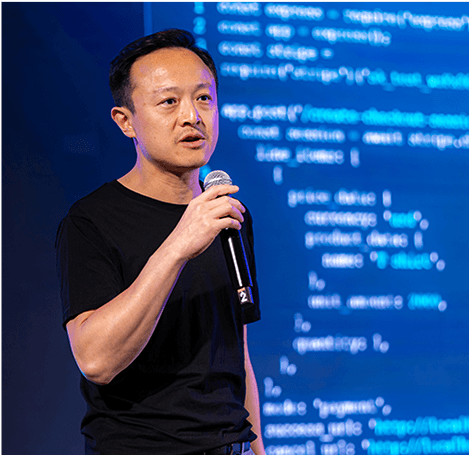

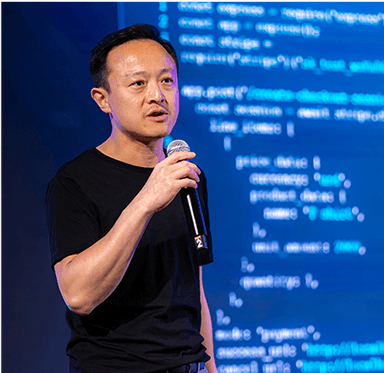

As Venky, Co-Founder of Metrom, shared during our recent Twitter Space:

“Most protocols go with an incentive system we call the ‘spray and pray’ method. They just spray incentives into the community and pray LPs show up. But that usually doesn’t happen.”

That model often results in unstable APRs, poor user retention, and a cycle that undermines both projects and their communities.

Metrom flips the script by:

- Tying rewards to clear KPIs (like Total Value Locked)

- Adjusting APR dynamically as performance improves

- Returning unclaimed rewards to the project—so nothing is wasted

LightLink x Metrom: How It Works

After a successful first round with Metrom across three Uniswap v3 pools, LightLink is now launching Round 2 of its KPI-based incentive program with Metrom—this time expanding to three Uniswap v3 pools. The new incentives are as follows:

- USDC–USDT — 750,000 LL in rewards, up to 31% APR at $500K TVL

- WETH–LL.e — 500,000 LL in rewards, up to 41% APR at $250K TVL

- WETH–USDC — 550,000 LL in rewards, up to 45% APR at $250K TVL

How to Participate:

- Head to the pool’s dedicated page on Metrom.

- Click the Deposit button (top-left)—this will redirect you to the Oku’s Position Manager.

- Add liquidity to the selected Uniswap v3 pool directly via Oku.

- Return to Metrom to track your rewards and claim incentives, either daily or at the end of the campaign.

Why Metrom Is Smarter Than Traditional Farming

In typical liquidity mining programs, rewards are fixed and distributed proportionally. If a project allocates $1,000 in incentives, an LP who provides 90% of the liquidity usually gets 90% of the rewards. That setup discourages smaller LPs, dilutes long-term engagement, and creates a “first in, most out” dynamic.

Metrom flips that model.

Instead of static rewards, Metrom introduces KPI-based incentives—where rewards scale dynamically with the pool’s performance. For example, as Total Value Locked (TVL) grows, so does the APR. The reward rate starts lower and ramps up as the community hits growth milestones, encouraging broader participation and longer-term alignment.

It’s a more flexible, programmable, and sustainable approach to incentivizing liquidity—one that rewards value, not just speed.

Metrom in Action: KPI-Based Rewards Explained

Metrom lets projects structure rewards using a classic concave, saturating growth curve—meaning APR increases as TVL grows. During LightLink’s initial campaign for the WETH/LL.e pool on Uniswap, the base reward started at 17% APR with a potential max of 47% if the pool hit its TVL target.

So, if you had deposited $1,000 at launch, you’d earn 17% APR. But as more LPs joined and TVL increased, the APR scaled up. By the end of the campaign, the KPI target was hit—and participants enjoyed an impressive 37% APR.

It’s a model where every contribution helps the pool—and boosts potential rewards for everyone involved.

If the pool doesn’t hit its target and some rewards go unclaimed, those incentives are simply returned to the project. Nothing is wasted on opportunistic farming—only meaningful participation is rewarded. With Metrom, every token distributed aligns with real contribution.

A Smarter Way Forward for DeFi

Metrom offers a smarter, fairer, and more sustainable approach to liquidity incentives—one that ties rewards to actual performance, not just early participation. By aligning incentives with TVL growth, it creates a win-win model for both protocols and LPs.

LightLink’s successful rollout of KPI-based incentives demonstrates how thoughtful, data-driven innovation can drive deeper engagement and long-term ecosystem value. As DeFi continues to evolve, platforms like Metrom will be essential in shaping its next chapter.

The campaign runs for 21 days. Explore the pools and start earning here: app.metrom.xyz